The belief in the “U” prevails - but with a critical view on the number of new infections

The strong rally on the stock markets in recent weeks has surprised many market participants. The global stock market index MSCI World is now only about 8 below its value at the beginning of the year. While the bad news about the economic development as a result of the global restrictions to contain the Covid-19 virus became more and more concentrated and economic expectations became increasingly gloomy, the investors bought stocks on a considerable scale.

The strong rally on the stock markets in recent weeks has surprised many market participants. The global stock market index MSCI World is now only about 8 below its value at the beginning of the year. While the bad news about the economic development as a result of the global restrictions to contain the Covid-19 virus became more and more concentrated and economic expectations became increasingly gloomy, the investors bought stocks on a considerable scale. Commentators are not seldomly recognizing a decoupling of the stock markets from the real economy and are expressing considerable doubt that investors are "correctly" pricing in the current and future effects of the pandemic. All players are currently in uncharted territory, and the vast majority of us have never faced a pandemic of this kind – which has changed our lives so radically so quickly – before. Of course, the players in the financial markets are feeling the same. We must therefore assume that the pricing on the markets in the near future will be influenced by quite significant reassessments of the outlook. The capital markets will therefore remain volatile for the time being, but this does not leave us in any doubt about the information efficiency of current market prices.

There are various explanations for the positive development of the stock markets. The markets are certainly influenced by the expectation that the economy will make a dynamic recovery in the course of next year after the perceived slowdown caused by the international shutdown in the fight against the spread of the virus. The International Monetary Fund (IMF) forecasts global economic growth of almost 6 for 2021. As stock markets are looking very far into the future, it is almost irrelevant whether the recovery will take place in a thin or thick “U”. Apart from this confidence that the cause of the crisis can be largely resolved medically by next year at the latest and that the economy will then return to a "new normality", the enormous capital investment pressure will presumably also contribute to the positive stock market development. With the expectation that interest rates worldwide will remain at very low levels for a very long time, investors simply lack the alternatives to equity investments. In addition, equities are likely to be in demand as investments in real companies in an environment of sharply rising government debt and enormous money creation.

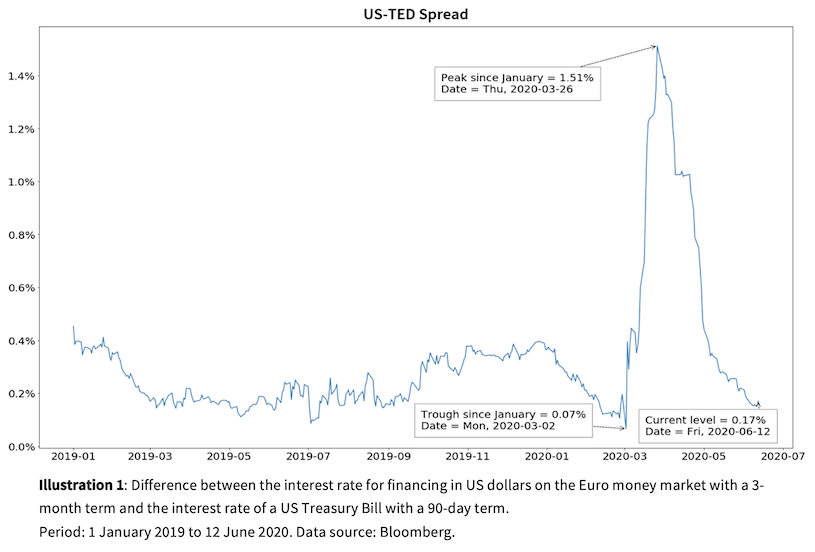

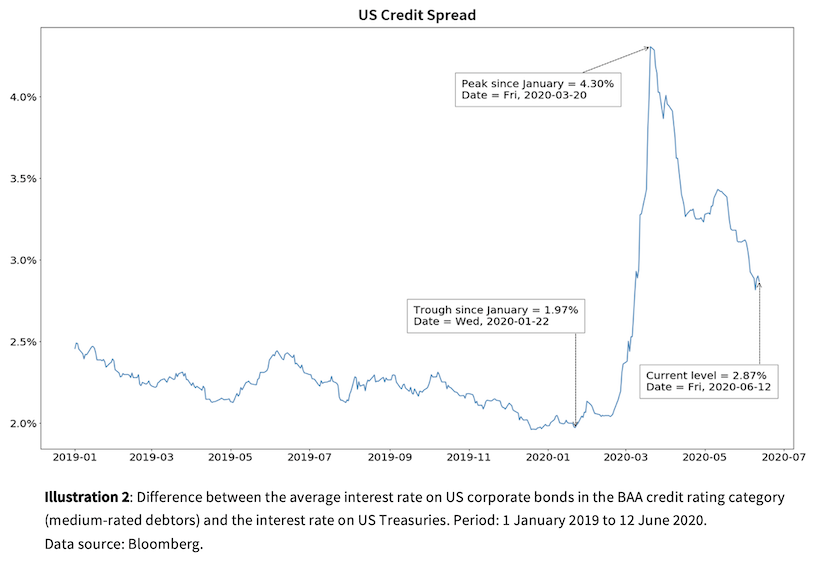

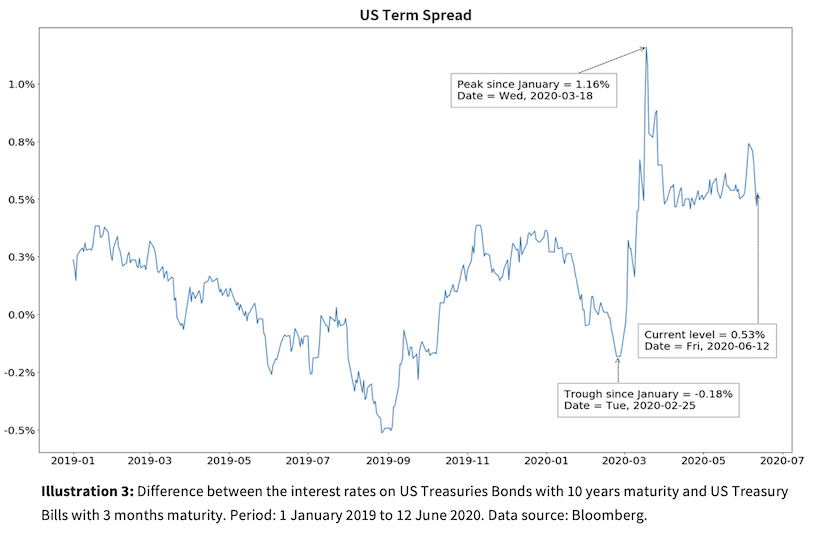

In the last two issues of the Market Insight, we had worked out that the willingness to take risks on the capital market in the current situation depends primarily on the success in combating the pandemic and on the measures taken by political institutions to stabilize the economy and capital markets. In our Market Insight of 21 April, we concluded that investors obviously believe in the effect of the global efforts and measures to mitigate the crisis and that confidence in the market is slowly coming back. Our conclusion was based, among other things, on an analysis of market participants' expectations as reflected in certain interest rate differentials. In the following we return to this approach of analyzing "traded expectations". We look at the US TED spread, the US credit spread, and the US TERM spread (see annex) in order to classify the market development of the last few weeks in the perspective of the interest rate markets.

The US TED spread (illustration 1), the difference between the interest rate for US dollar financing in the euro money market and the interest rate of a US Treasury Bill, each with a term of 3 months, corresponds to the prevailing confidence of market participants in the financial system and the general liquidity preference. The deep market uncertainty in the course of March caused the TED spread to jump from a value close to zero to around 1.5 (on 26 March). In the meantime, the situation has completely eased again; currently (on 12 June) the US TED spread is 0.17. The strongly expansive emergency measures taken by the major central banks have had an almost perfect effect; similar to the situation in recent years, the market is swimming in liquidity. This is probably one reason for the relative robustness of the stock markets.

The US credit spread (illustration 2), represented by the difference between the interest rate on US corporate bonds in the BAA credit rating class (medium-quality debtors) and the interest rate on US Treasuries, reflects the market’s assessment of the health of companies. This spread reached 4.3 on 20 March as a result of the pandemic shock. Since then, it has tended to narrow again and currently (on 12 June) stands at 2.9. Although the risk premium has not yet returned to pre-crisis levels (2.0 to 2.5), it has contracted considerably in recent weeks. This development, like the advances of the stock market, is based on the growing confidence of investors in the numerous rescue packages and measures with which governments are trying to bring the economy through the crisis.

The US TERM spread (illustration 3), the difference between the interest rates on US Treasuries with 10 years maturity and those with 3 months maturity, is a proxy for economic expectations traded in the market. This spread is currently moving sideways at a level of 0.5. Although the two surprising interest rate cuts by the US FED in March and the other measures taken had caused the spread to climb to 1.16 (on 18 March), the yield curve flattened again very quickly. According to an announcement on 8 June by the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER), the USA has officially been in recession since March 2020. This is quasi official confirmation of what was already evident in 2019 from the very flat and repeatedly inverted US yield curve. The intervention by the US Federal Reserve thus took place at a time when the US economy was already in reverse gear. As long as the TERM spread remains at this level, negative economic expectations will influence market developments.

Conclusion

The markets have definitely overcome the panic mode and believe in a return to economic growth by 2021 at the latest. In addition, structural factors such as the exorbitant market liquidity, the investment pressure of institutional investors in search of returns and a preference for investments in real assets like stocks companies in the face of growing government debt worldwide are supporting stock market prices. Nevertheless, economic uncertainties are still omnipresent these days, which can trigger considerable corrections and distortions on the markets in the short term. One of the biggest risks in this context is certainly a possible "second wave" of the corona pandemic with renewed drastic effects on social and economic life. Any sign of such a renewed wave of infection in one of the major industrial nations will immediately put economic confidence for 2021 to the test and lead to revaluations on the stock markets. Basic optimism prevails, but expectations and prices remain fragile.

Author

Dr. Peter Oertmann | Chairman of the board

oertmann@ultramarin.ai

Appendix