Equities prices and inflation expectations: A multilayered topic

Inflation has become an issue again. Measures taken by governments and leading central banks to stabilize the economy since the outbreak of the Covid-19 pandemic have raised inflation expectations. Large fiscal rescue packages, financed by government bonds, combined with determined monetarization by central banks have brought a lot of new money into circulation.

Inflation has become an issue again. Measures taken by governments and leading central banks to stabilize the economy since the outbreak of the Covid-19 pandemic have raised inflation expectations. Large fiscal rescue packages, financed by government bonds, combined with determined monetarization by central banks have brought a lot of new money into circulation. Although it is not possible at all to predict the extent to which inflationary price increases will actually occur, so much new money generally fuels the inflation expectations of market participants. The massive fiscal stimulus in the United States to combat the crisis - in particular the $ 1.9 trillion stabilization program recently announced by Joe Biden - has already caused interest rates on long-dated U.S. government bonds to rise noticeably. Since the beginning of the year, the interest rate on U.S. government bonds with a remaining term of 10 years has risen from 0.91 % to 1.63 % (as of April 30). This significant rise in interest rates is mainly due to higher inflation expectations.

In an environment of rising inflation expectations, investments are in demand that can be expected to provide a certain degree of protection against inflation. In addition to real estate and gold, these include above all investments in equities as co-ownership shares in companies. However, the extent to which shares can be regarded as 'real investments' with inflation protection is discussed in academic research. There are two opposing hypotheses: The so-called hedging hypothesis postulates that investors see stocks primarily as real investments and that inflation causes the aggregate demand for stocks to grow. As a result, stock prices would rise as inflation expectations increase. The money illusion hypothesis assumes that investors discount the real cash flows of companies in principle in nominal terms and that an increased discount rate due to rising inflation expectations causes stock prices to fall. There is ample empirical evidence to support both hypotheses. Thus, the relationship between inflation and stock prices is not that clear.

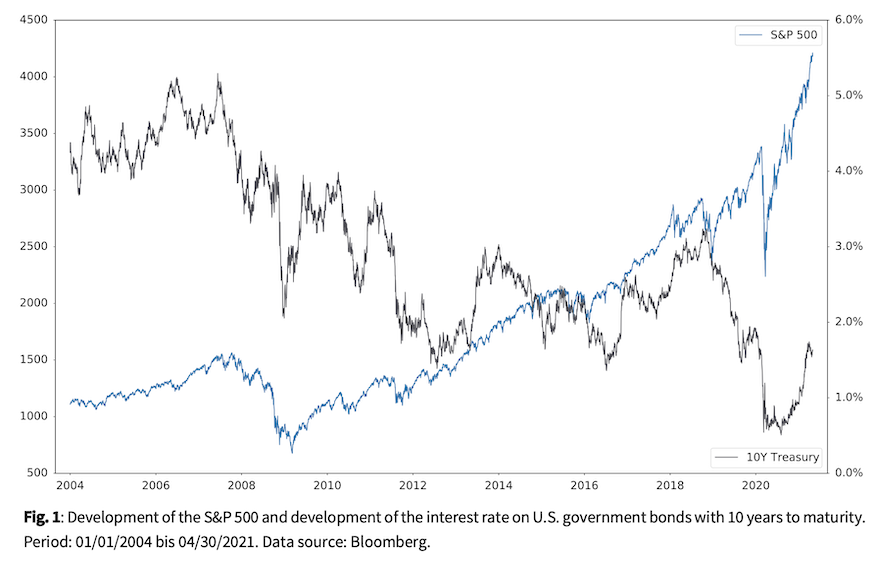

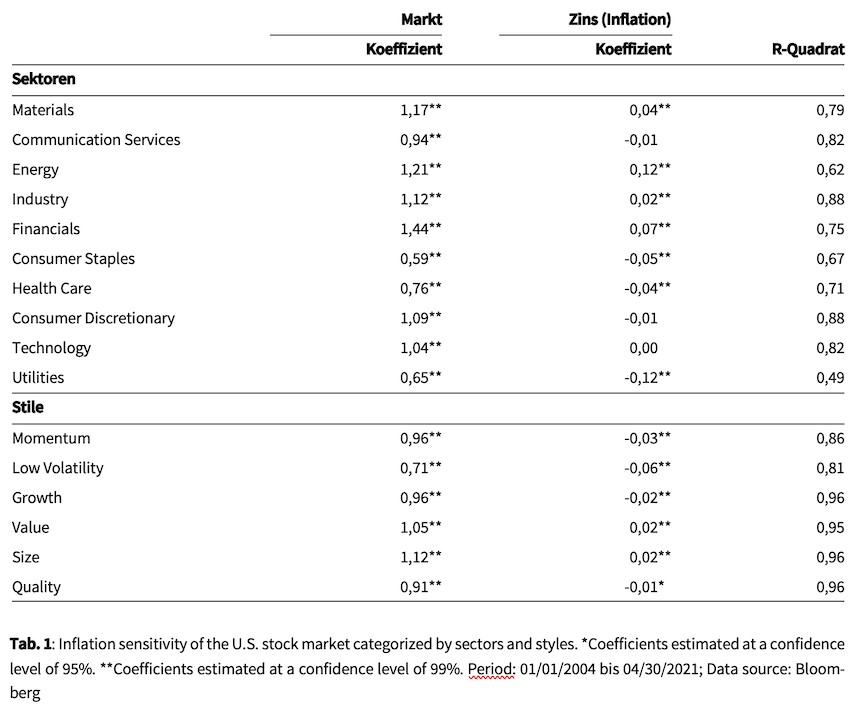

We examine the inflation sensitivity of the U.S. stock market and approach the topic in this short paper with regression analyses. Our empirical investigation covers ten sectors as well as six investment styles based on the S&P 500 stock universe over the period from Jan. 1, 2004 to April 30, 2021. We regress the weekly returns of the stock segments (sectors, styles) on the contemporaneously measured returns of the S&P 500 total market index as well as a proxy variable for the changes in inflation expectations in the market - our analysis is based on a total of 903 data points. As a proxy, we use changes in the yield on U.S. government bonds (Treasuries) with 10 years to maturity. Our approach is based on the assumption that weekly changes in government bond yields primarily reflect continuous adjustments in inflation expectations. To separate the influences of market trends and inflation expectations in our regressions, in order to avoid multicollinearity in the explanatory variables, we perform an orthogonalization procedure. Finally, we regress the weekly returns of the stock segments on the returns of the S&P 500 total market index and the changes in inflation expectations that are orthogonal to the total market index. Figure 1 in the appendix shows the evolution of the S&P 500 and of the interest rate on U.S. government bonds with 10 years to maturity over the relevant time period.

The results of our analysis are summarized in table 1 in the appendix. We will not comment on the sensitivities to the S&P 500, that is the market betas of sectors and styles, which range from 0.65 (Utilities) to 1.44 (Financials) for sectors and from 0.91 (Quality) to 1.12 (Size) for investment styles. These estimates are consistently in line with common expectations regarding the market sensitivity of different sectors and styles. Our focus is on sensitivities to inflation expectations. These estimates are very small for all stock segments considered, i.e. the inflation expectations we modelled have a marginal impact on stock returns.

Four sectors show a statistically significant positive sensitivity to changes in inflation expectations: the cyclical sectors basic materials, energy, industry and financials. We find significantly negative sensitivities for consumer staples, healthcare and utilities, thus for defensive sectors that tend to be non-cyclical. Since economic momentum always triggers an increase in inflation expectations, these results are plausible. Among the investment styles, there are significantly positive sensitivities to changes in inflation expectations for Value and Size and significantly negative sensitivities for Momentum, Low-Volatility, Growth and Quality.

Conclusion

Our results do not suggest that changes in inflation expectations as reflected in long-term interest rates are a prominent driver of stock market returns. Equities certainly offer better protection than bonds, which definitely lose value in a rising interest rate environment due to rising inflation expectations with their fixed income coupons. In the equity market, it tends to be stocks from sectors that are sensitive to the economic cycle, ideally in combination with the investment styles Value or Size (Small Cap), that offer the best protection against inflation. As initially stated, two basic hypotheses for the impact of inflation expectations on stock prices oppose each other: Hedging vs. Money Illusion. Our review does not clearly support either hypothesis. How exactly market participants in times of emerging inflation expectations adjust their dividend expectations for companies and then discount the dividend stream remains a multi-layered issue.

Author

Dr. Peter Oertmann | Chairman of the board

oertmann@ultramarin.ai

Datan analysis

David Dümig | Senior Quantitative Investment Researcher

duemig@ultramarin.ai

Appendix: