Flight-to-Safety has decreased. On the threshold of a new regime?

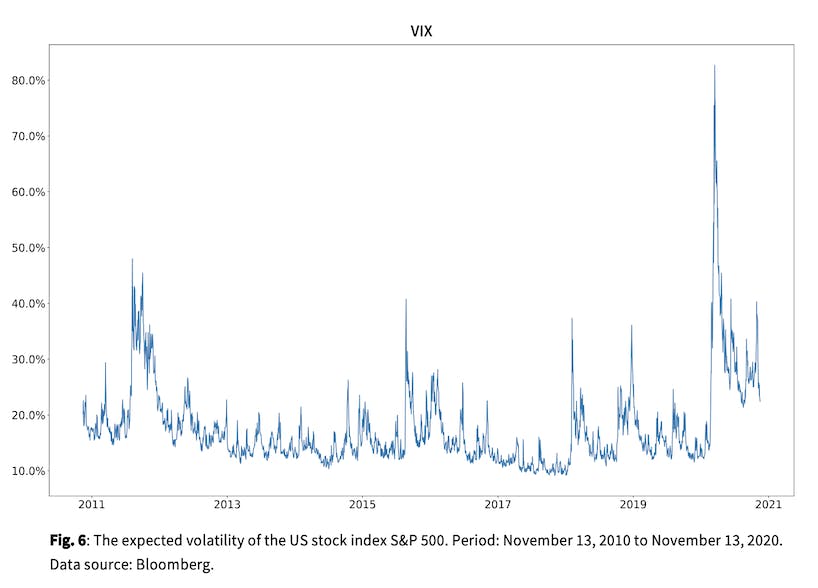

In the last few days, two news have moved global stock markets significantly: The election of Joe Biden as the next President of the United States and the announcement that there is promising progress in the development of an effective vaccine against Covid-19. Both news pieces were very well received by the markets, as evidenced by the CBOE volatility index VIX.

In the last few days, two news have moved global stock markets significantly: The election of Joe Biden as the next President of the United States and the announcement that there is promising progress in the development of an effective vaccine against Covid-19. Both news pieces were very well received by the markets, as evidenced by the CBOE volatility index VIX. As more and more parts of the U.S. map turned blue during the night of November 3 to 4, the implied volatility in the U.S. stock market fell from about 35% to about 29%. As the election results hardened and were determined, the implied volatility continued to fall in the following days to values around 25%. The press release by BioNTech SE and Pfizer Inc. on November 9 that their joint Covid-19 vaccine candidate BNT162b2 proved to be more than 90% effective in a first interim analysis additionally boosted the stock markets and caused the VIX to drop to values between 22% and 23%. The well-founded expectation that the political leaders of the world's largest economy will again act in a more cooperative and predictable manner in the future and the renewed hope that the corona pandemic can be overcome with vaccines in the foreseeable future have noticeably increased the risk appetite of market participants during the last two weeks.

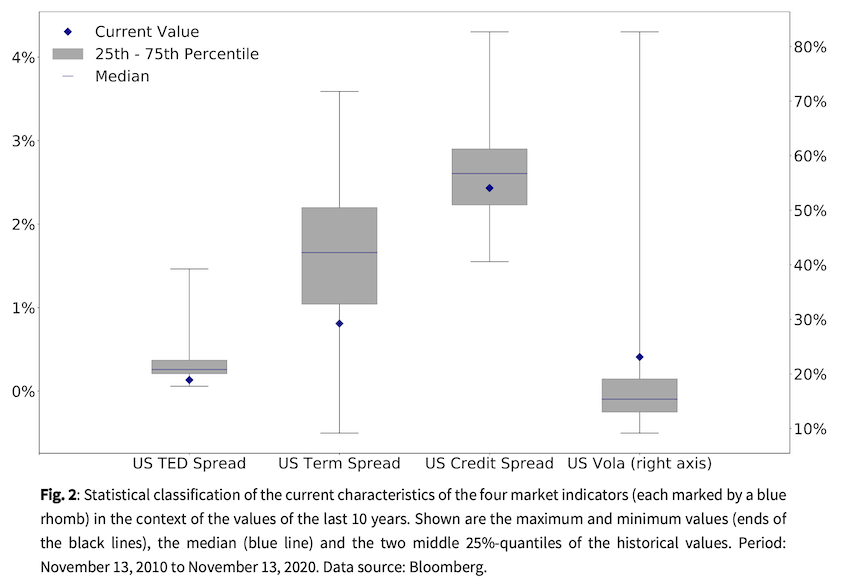

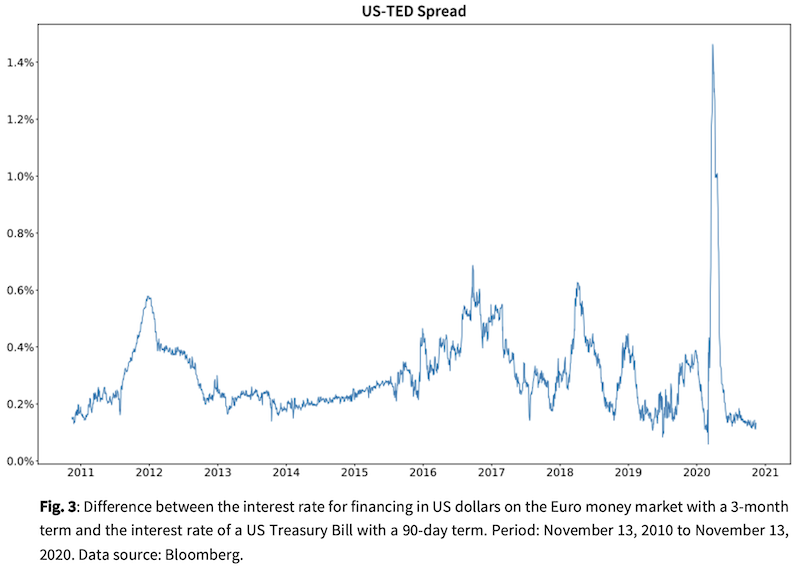

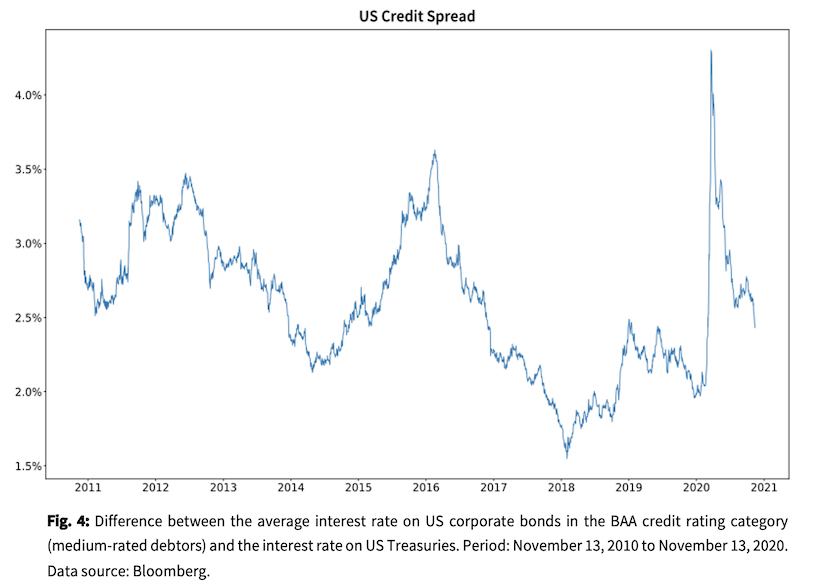

Uncertainties are effectively being reduced and the capital markets seem to be gradually emerging from the crisis mode. In the last Market Insights we used the US TED Spread, the US Credit Spread and the US TERM Spread as well as the VIX to analyze the development of risk appetite on the capital market - in the appendix you will find the corresponding statistical classifications and charts with current data. Today, our analytical focus is on the correlation between equity market returns and long-term government bond returns.

The equity-government bond correlation basically shows how market participants weigh up the opportunities in the equity markets against the security of government bonds due to the reallocation of funds. If you look at long time periods, you will find a positive correlation between equity and government bond returns – i. e. positive/negative equity returns tend to go hand in hand with positive/negative government bond returns. This long-term positive correlation results from the fact that the prices of both stocks and bonds are the result of discounting cash flows (stocks: dividends, bonds: interest coupons) and that changes in market interest rates therefore impact prices with the same sign via the discount factor. When capital markets are in crisis mode, a pronounced negative correlation between equity and bond returns is usually observed. If investors reduce the risk of their portfolios when the outlook is uncertain, e. g. sell shares and buy government bonds, the resulting negative price developments on the stock market correspond to positive price developments of government bonds. If investors in the aggregate take such a flight-to-safety the result is a negative correlation. The more negative the correlation between equity and government bond returns, the more funds are shifted into safety.

Figure 1 shows the correlation between the return of the S&P 500 equity index and the return of 10 year U.S. government bonds, measured over a 3-month moving window (63 trading days) since the beginning of the year. Already at the beginning of 2020, the capital markets tended to be in crisis mode due to significant geopolitical pressures such as the trade war between the US and China and the instabilities in Europe around the Brexit; the correlation between equity and government bond returns was already between -0.3 and -0.4. The outbreak of the Covid-19 virus in the Chinese metropolis Wuhan and the development from a regional epidemic to a worldwide pandemic caused the correlation to drop very significantly to values around -0.7 in the course of the first quarter of the year. This was the entry of the capital markets into a phase of great uncertainty with a pronounced flight-to-safety. Despite the massive support measures taken by governments and central banks, the correlation between US equity and government bond returns remained within this regime until the end of May. This is certainly also due to the rapid spread of the virus in many US states, which was partially uncontrolled until the summer and which put a strain on economic prospects not only in the US but also worldwide. Merely in the course of the summer, with the progress made in fighting the virus and then in the autumn, with the prospect of a change of government in the White House becoming more tangible, did the crisis regime weaken noticeably, accompanied by a significant weakening of the negative equity-government bond correlation. After the election of Joe Biden as new president in early November, the correlation then jumped almost towards zero.

Conclusion

From this simple analysis, which is ultimately based on a great amount of market information, it can be concluded that since the beginning of autumn the uncertainties on the capital market have diminished and that a new regime may have begun with the clarity about the new US administration. The expectation, increasingly strengthened by the central banks, that key interest rates in the most important currencies will remain very low in the long term has contributed significantly to the fact that flight-to-safety has become less frequent and the correlation between equity and government bond returns has thus gradually left the crisis regime of strongly negative values behind.

President-elect Joe Biden will take power in the White House in January. There is no doubt about that, despite the current president's desperate Twitter attacks. The political integrity of the United States and its committed integration into the multilateral world order are and remain essential hygiene factors for constructive sentiment on the capital markets. In addition, one or more vaccines against Covid-19 will be available in the foreseeable future, and at some point, it will be possible to start using them to further contain the pandemic. These are two important perspectives that will have a positive impact on the capital markets from now on and will strengthen the risk appetite of the participants.

Autor

Dr. Peter Oertmann | Chairman of the board

oertmann@ultramarin.ai

Appendix