The constructive mood on the capital market is solidifying - investors are focusing on resilience and technology

The midterm economic consequences of the Covid-19 pandemic still cannot be estimated. Clearly, the current episode will have a pro-found impact on the economy and will bring people's lives into a new normality. What exactly this new normality will then look like is also not yet clear.

The midterm economic consequences of the Covid-19 pandemic still cannot be estimated. Clearly, the current episode will have a pro-found impact on the economy and will bring people's lives into a new normality. What exactly this new normality will then look like is also not yet clear. The global infection situation, especially in the United States of America and some converging countries, is a strong signal that the spread of the virus is far from under control. Add to this the developments in China and Hong Kong, the rapidly growing political division among the American population, the ever-recurring trade conflict between the USA and China, and a heterogeneous Europe that is constantly struggling to find common ground. None of this contributes to the stabilization of perspectives. All in all, the current way of thinking and acting of investors is characterized by enormous uncertainties.

In the last Market Insight (on 16 June) we concluded that the capital markets have definitely overcome the panic mode and believe in a return of economic growth by 2021 at the latest. Despite the continuing difficult global situation outlined in the first section, the positive trend on the equity markets has become even stronger in recent weeks. On July 20, the global stock market index MSCI World was only about 1.7% below its value at the beginning of the year - almost as if nothing had happened. The currently measurable implicit volatility on the American stock market is around 25%; although this is slightly higher compared to historical values, it is no indication of fragile circumstances. The fundamental reasons for the impressively rapid recovery from the pandemic shock and the robust demand for equities over the past weeks were discussed in detail in our latest Market Insights: Investors' long-term thinking, combined with exorbitant market liquidity, massive economic stimulus packages worldwide, the hope that a vaccine will soon be available, and the apparent rediscovery of equity shares as a real investment opportunity.

The constructive attitude of market participants makes the stock market quite resistant to the news flow at the moment. Nevertheless, investors are dealing with the historical crisis and its possible consequences in a differentiated manner. This is shown by a closer look at the classic safe havens for investment capital, the currency markets, and style preferences on the stock market. Here are a few facts:

- The price of gold has risen by almost 20% since the beginning of the year, and government bonds have also increased significantly, US Treasuries by around 7% and European government bonds by almost 3%.

- The US dollar has weakened by around 2% compared with the Euro since the beginning of the year, the British Pound by more than 7% and the Brazilian Real even by more than 35 %.

- Value stocks in the MSCI World Index have lost around 15% since January 1, while growth stocks have increased by almost 14%. The technology index NASDAQ Composite has even risen by more than 20%.

These few highlights of selected price changes since the beginning of the year clearly illustrate that capital allocations in the current environment are made in a very sophisticated way: Investors hold large amounts of macro hedges such as gold and government bonds in their portfolios, distinguish between countries and economic areas in terms of their crisis resilience (weakening of USD, GBP and BRL against EUR) and focus on growth and technology stocks in the equity markets.

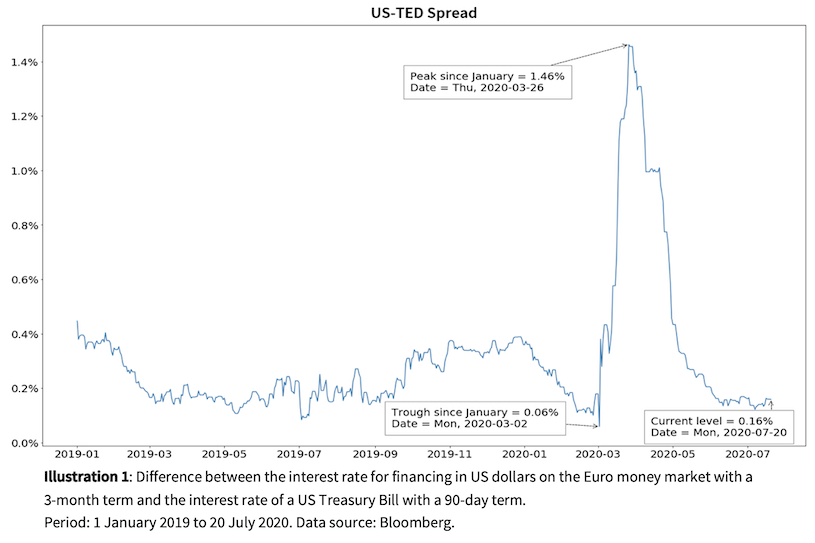

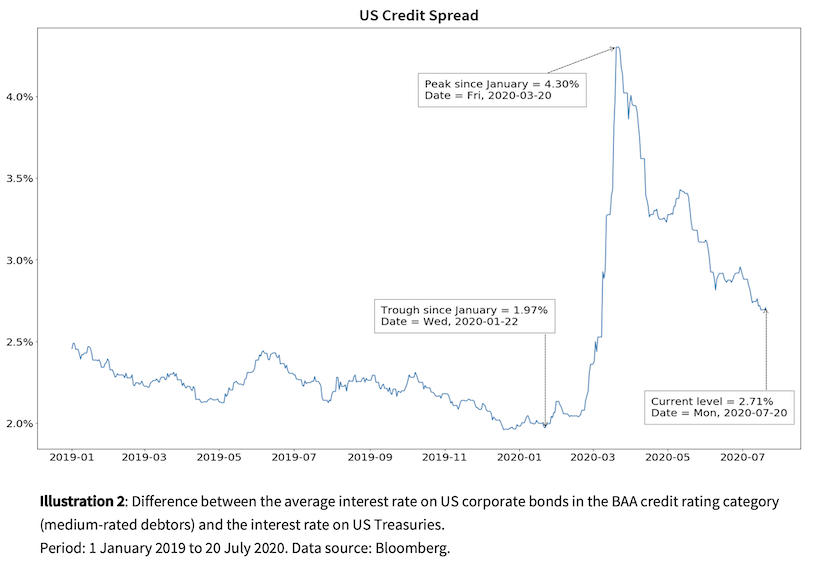

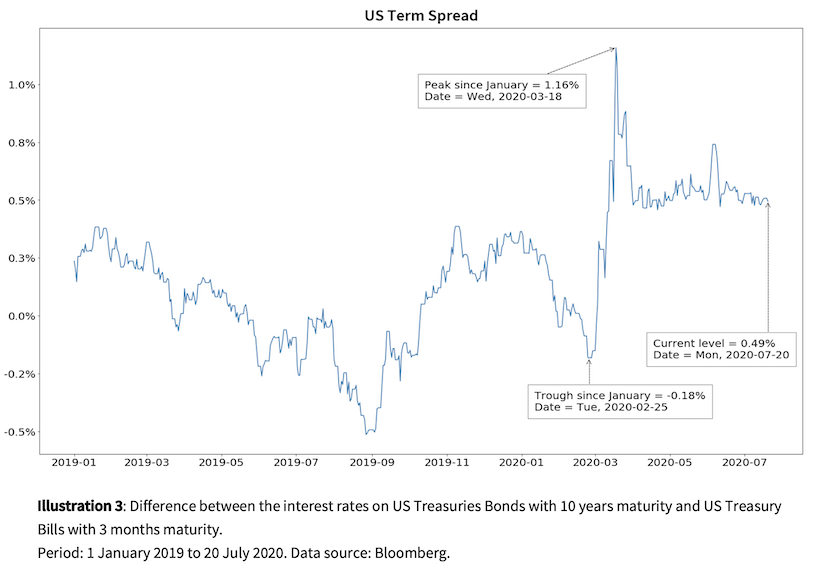

As in the previous Market Insights, we conclude by taking a look at selected interest rate differentials, since the prevailing expectations of market participants and, in particular, their current attitude towards systematic risks can be read off in a transparent and economically meaningful way. We base our analysis on interest rates in the US dollar and in the highly liquid US bond markets. The US TED Spread, the US Credit Spread and the US TERM Spread are examined during the pandemic phase thus far, together with a classification in the historical context.

The US TED spread, the difference between the interest rate for US dollar financing in the euro money market and the interest rate of a US Treasury Bill, each with a term of 3 months, corresponds to the prevailing confidence of market participants in the financial system and the general liquidity preference. The deep market uncertainty in the course of March, accompanied by sudden concerns about the stability of the financial system, caused the TED spread to increase sharply from a value close to zero to around 1.5%. Currently (on 20 July) the US TED spread is 0.16%, and practically has not changed since our last report. Under the impact of the massive injection of liquidity by the central banks, the situation has very quickly calmed down entirely and no further disturbances in the financial system are expected. The rise in the US TED spread at the beginning of the global financial crisis in 2008 was much greater, and the calming phase lasted much longer.

The US credit spread, represented by the difference between the interest rate on US corporate bonds in the BAA credit rating class (medium quality debtors) and the interest rate on US Treasuries, reflects the health assessment of companies in the market. This spread reached 4.3% on 20 March as a result of the pandemic shock. Since then, it has tended to converge again, and currently (20 July) stands at 2.68%. Although the risk premium has thus not yet quite returned to pre-crisis levels (2.0% to 2.5%), it has continued to decline very significantly in the past few weeks. Investors' confidence in the numerous bailout packages and measures by which governments are trying to get the economy through the crisis has increased even more since our last review.

The US TERM Spread, the difference between the interest rates on US Treasuries with 10 years to maturity and those with 3 months to maturity, is a proxy for economic expectations traded in the market. This spread continues to move sideways at a level of around 0.5%. The two surprising interest rate cuts by the US FED in March and the other measures had caused the spread to climb briefly to a value of 1.16%, but the interest rate curve flattened again very quickly. According to an announcement on 8 June by the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER), the USA has officially been in recession since March 2020. This is an official confirmation of what was already evident in 2019 from the very flat and repeatedly inverted US yield curve. Hence, the intervention of the US central bank took place at a time when the US economy was already in reverse motion. As long as the TERM remains at this level, negative economic expectations will affect market activity.

Conclusion

The markets continue to demonstrate strength to the mostly shocking news from the global pandemic centres and also to the current economic data. The impressive resistance of equity valuations - which is sometimes interpreted as a disconnection from the real world - is based not only on growth hopes for the post-Corona period, but also and especially on structural factors such as enormous market liquidity, investment pressure from institutional investors and the preference for equity shares of real companies in the context of growing government debt worldwide. However, it will continue to be very volatile for a long time. At any time, investors should expect significant distortions in risk-bearing assets. Among the significant risks are a persistent inability of the US administration to effectively contain the first wave of the corona pandemic, or a possible second wave of infection in Europe with renewed drastic effects on social and economic life. The currently prevailing economic confidence may very rapidly come under scrutiny again and lead to revaluations on the stock markets. However, it is exciting to note that the markets already have a certain idea of the new normality. The criteria 'resilience' and 'technology' appear to be at the top of the list of guiding principles for commitments on the capital market.

Author

Dr. Peter Oertmann | Chairman of the board

oertmann@ultramarin.ai

Appendix